In the world of real estate investment, the 1031 Exchanges stands out as a powerful and often underutilized tool. This tax-deferral strategy, enshrined in Section 1031 of the Internal Revenue Code, offers a myriad of advantages to savvy investors. In this comprehensive guide, we will delve into the benefits of using a 1031 exchange, shedding light on how it can drive wealth creation, portfolio growth, and long-term financial success.

I. Tax Deferral and Capital Preservation

A. Deferring Capital Gains Taxes

One of the most significant advantages of a 1031 exchange is the ability to defer capital gains taxes. When you sell a property and reinvest the proceeds into another, like-kind property, you can postpone the payment of capital gains taxes that would typically be due upon the sale. This tax deferral is invaluable, allowing you to retain more of your investment capital.

B. Enhanced Cash Flow

By deferring taxes, you have more funds at your disposal for the acquisition of new properties. This enhanced cash flow enables investors to access better opportunities and diversify their real estate portfolios.

C. Accelerated Portfolio Growth

With the ability to reinvest the full sale proceeds, investors can grow their property portfolios at an accelerated rate. This compound growth effect is a significant boon for long-term investors.

II. Portfolio Diversification

A. Opportunity for Property Diversification

The 1031 exchange offers investors the flexibility to diversify their real estate holdings. You can exchange one type of property for another, allowing you to adjust your portfolio to meet changing market conditions or investment goals.

B. Risk Mitigation

Diversification not only spreads risk but can also provide a safeguard against market downturns in specific property types. It is a strategic approach that can help maintain a stable and resilient investment portfolio.

C. Transition to Passive Investments

Investors can leverage 1031 exchanges to transition from actively managed properties to passive investments such as Delaware Statutory Trusts (DSTs) or real estate funds. This shift can reduce the burden of hands-on property management.

III. Wealth Building and Legacy Planning

A. Wealth Accumulation

With taxes deferred, investors can maximize the amount of capital working for them. This wealth accumulation is a cornerstone of long-term financial success, as the reinvested capital can generate additional income and property appreciation.

B. Generational Wealth Transfer

1031 exchanges can play a vital role in generational wealth transfer. By continually deferring taxes and growing your real estate holdings, you can leave a more substantial financial legacy for your heirs.

C. Retirement Income

As you approach retirement, 1031 exchanges can be a valuable tool for securing a consistent income stream from your real estate investments without the burden of capital gains taxes.

IV. Facilitation of Strategic Moves

A. Property Upgrades

Investors can use 1031 exchanges to upgrade to higher-value properties without incurring immediate tax liabilities. This tactic helps optimize the quality and potential returns of your real estate investments.

B. Geographical Diversification

Expanding your real estate investments to new geographic regions is simplified with 1031 exchanges. You can sell properties in one area and use the proceeds to acquire properties in another, diversifying your holdings and risk.

C. Timing the Market

In a dynamic real estate market, 1031 exchanges offer the flexibility to time your property sales and acquisitions strategically, taking advantage of market trends.

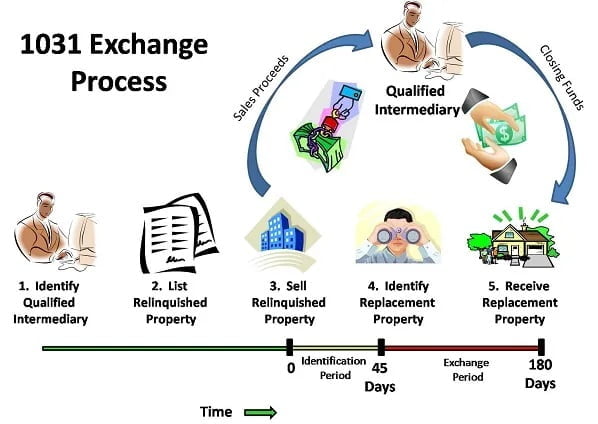

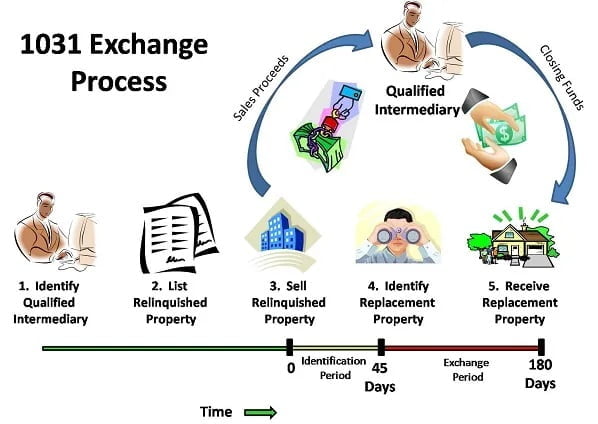

V. Using a 1031 Exchanges

The benefits of using a 1031 exchange are manifold. This tax-deferral strategy empowers investors to defer capital gains taxes, preserve capital, diversify their portfolios, build wealth, plan for their financial future, and make strategic moves in the real estate market. For those with a long-term investment horizon, the 1031 exchange is a powerful tool that can drive financial success and leave a lasting legacy.

As with any financial strategy, it’s essential to seek professional guidance and adhere to IRS regulations when using a 1031 exchange. By leveraging this tool effectively, investors can unlock the full potential of their real estate investments and achieve their financial goals.

VI. Flexibility in Investment Decision-Making

A. Unleashing Investment Capital

1031 exchanges provide investors with the flexibility to access and deploy their entire capital from the sale of a relinquished property into a new investment. This liberation of funds allows investors to seize unique opportunities that might otherwise be financially challenging.

B. Adapting to Changing Objectives

Investment goals and market conditions can evolve. 1031 exchanges empower investors to adapt to changing objectives, whether shifting from capital appreciation to income generation, or vice versa, without the burden of immediate tax consequences.

C. Tailoring Investment Strategies

From residential and commercial properties to vacant land, 1031 exchanges offer the freedom to tailor investment strategies to align with individual objectives, risk tolerance, and market trends.

VII. Environmental Benefits

A. Encouragement of Green Investments

The IRS has recognized the importance of sustainability and energy efficiency in real estate. By promoting the use of 1031 exchanges for green investments, such as energy-efficient buildings or renewable energy projects, investors can contribute to environmental sustainability.

B. Tax Benefits for Green Investments

Investors engaged in eco-friendly properties may qualify for additional tax incentives, including energy-efficient commercial building deductions (Section 179D) or renewable energy tax credits. When combined with 1031 exchanges, these incentives can significantly boost returns.

VIII. Social Benefits

A. Support for Affordable Housing

Investors can use 1031 exchanges to engage in affordable housing initiatives. By reinvesting in properties with a focus on affordability, investors play a vital role in addressing the ongoing housing crisis.

B. Urban Renewal and Community Development

1031 exchanges can also contribute to urban renewal and community development projects. Investors redirect their capital to revitalize neighborhoods, improve infrastructure, and foster economic growth.

C. Supporting Small Businesses

Engaging in 1031 exchanges to acquire properties that house small businesses benefits local communities and supports entrepreneurial endeavors, furthering economic development.

IX. Retirement and Financial Planning

A. Income in Retirement

As retirement approaches, investors can use 1031 exchanges to transition their real estate investments into income-producing properties. This provides a reliable income stream for retirement living.

B. Estate Planning

1031 exchanges can be a valuable component of estate planning. The tax deferral and wealth accumulation made possible by this strategy can be leveraged to create a more substantial legacy for heirs.

C. Capital for Other Investments

Investors may use 1031 exchanges to release capital for non-real estate investments. The flexibility allows for a diversified financial portfolio that includes stocks, bonds, and other asset classes.

Benefits of 1031 Exchanges

The benefits of using a 1031 exchange extend beyond tax deferral. This versatile strategy provides investors with the tools to enhance their financial position, achieve diversification, support environmental and social initiatives, and plan for their retirement and estate legacy. As with any financial tool, it is crucial to consult with professionals well-versed in 1031 exchange regulations and to make strategic decisions that align with your unique investment objectives.

In a dynamic real estate market, the 1031 exchange stands as a timeless and valuable resource for investors seeking to optimize their investments and build long-term financial success. With a commitment to understanding and utilizing the benefits of the 1031 exchange, investors can unlock the full potential of their real estate portfolios and create a lasting impact in the financial world.

Call us today:

Call us today: