A 1031 exchange is a powerful tax-deferral strategy that allows real estate investors to sell one property and purchase another, like-kind property while deferring capital gains taxes. Mastering this process can unlock significant financial benefits and portfolio growth potential. In this guide, we’ll break down the 1031 exchange into 10 straightforward steps, making the seemingly complex process more accessible for investors.

I. Understanding the Basics

Step 1: Grasp the Fundamental Concepts

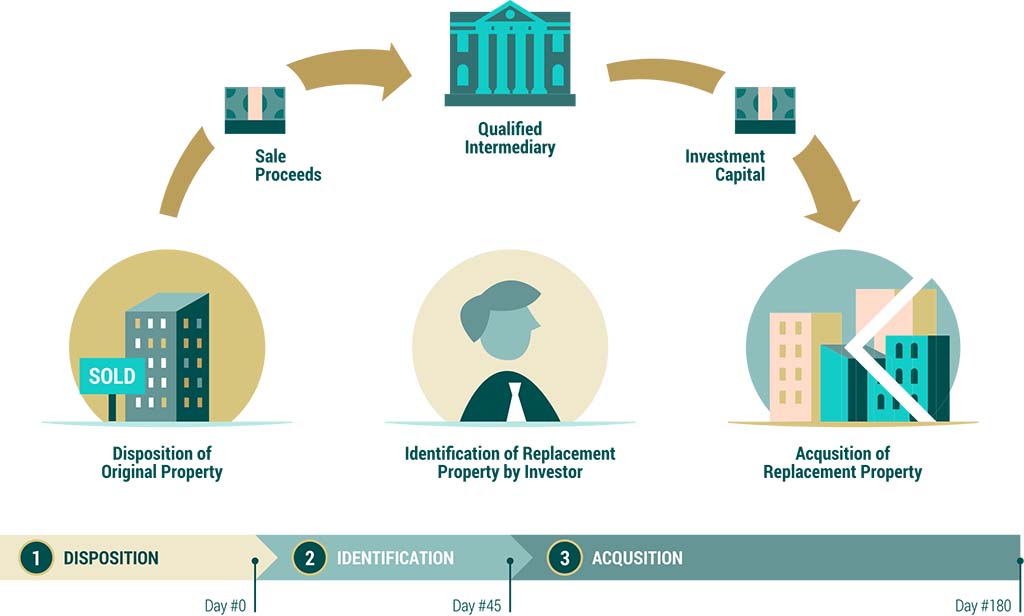

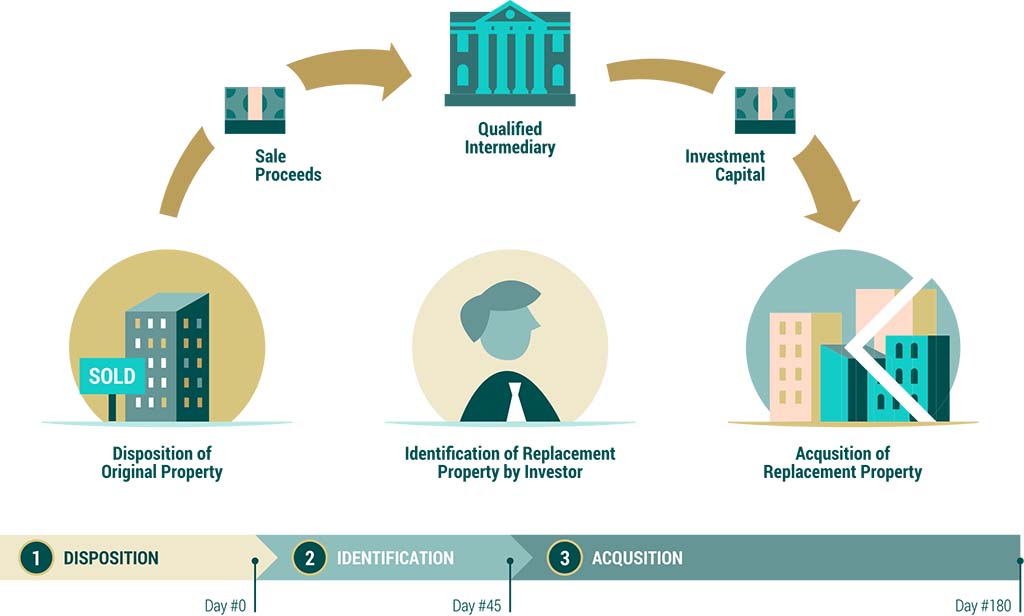

Begin by familiarizing yourself with the basic concepts of a 1031 exchange. Understand the like-kind property requirement, the role of a qualified intermediary (QI), and the strict timeline associated with these transactions.

Step 2: Determine Your Eligibility

Make sure you meet the eligibility criteria for a 1031 exchange. Individual investors, partnerships, corporations, LLCs, and other entities can participate, but primary residences do not qualify.

II. Preparing for the Exchange

Step 1: Choose Your Qualified Intermediary

Select a reputable qualified intermediary (QI) to assist with your 1031 exchange. The QI will handle the sale proceeds, guide you through the process, and ensure compliance with IRS regulations.

Step 2: Listing and Selling Your Relinquished Property

List your relinquished property for sale. Once you secure a buyer, work with your QI to include specific language in the sale contract outlining your intent to perform a 1031 exchange.

III. Identifying Replacement Properties

Step 1: Identify Potential Replacement Properties

Within 45 days of selling your relinquished property, identify up to three potential replacement properties. This identification is a critical and time-sensitive aspect of the process.

IV. Closing the Exchange

Step 1: Negotiate and Secure the Replacement Property

After identifying potential replacement properties, enter negotiations to purchase one or more of them. Once you secure a contract, proceed to close on the replacement property.

Step 2: Inform Your Qualified Intermediary

Notify your QI about the property you intend to acquire as a replacement. This step is essential to ensure compliance with IRS regulations.

Step 3: Finalize the Exchange

Close the exchange within 180 days of selling your relinquished property. Ensure that the transaction adheres to IRS guidelines and the identification rules.

V. Tax Reporting

Step 1: Complete IRS Forms

Work with your QI to complete the necessary IRS forms to report the exchange. These forms include IRS Form 8824, which details the specifics of the transaction.

VI. Post-Exchange Evaluation

Step 1: Evaluate the Benefits

With the exchange complete, assess the financial advantages and portfolio growth potential gained through the 1031 exchange. Consider reinvesting the tax-deferred capital into new opportunities, thereby maximizing the benefits of your exchange.

A 1031 exchange can be a game-changer in your real estate investment strategy. By following these 10 essential steps, you can navigate the process with confidence and unlock the benefits of tax deferral, capital preservation, and portfolio growth. It’s essential to work with experienced professionals, including a qualified intermediary and legal or tax advisors, to ensure that your 1031 exchange complies with IRS regulations and maximizes the financial benefits.

Remember that while this guide offers a broad overview, each 1031 exchange is unique and may require additional considerations based on your individual circumstances. With dedication and careful planning, you can use the power of a 1031 exchange to optimize your real estate investments and pave the way for long-term financial success.

Part 2: How to Do a 1031 Exchange in 10 Steps

VII. Post-Exchange Strategy

Step 1: Reinvest and Diversify

After successfully completing your 1031 exchange, consider reinvesting the capital into properties that align with your investment strategy. Diversify your portfolio, aiming for a balance between income-generating and appreciating assets.

Step 2: Passive Investments

Explore options like Delaware Statutory Trusts (DSTs) or real estate funds, which can offer a passive investment approach. These structures allow investors to enjoy the benefits of real estate ownership without direct management responsibilities.

VIII. Continuous Learning

Step 1: Stay Informed About Regulations

The tax code is subject to change, and regulations surrounding 1031 exchanges can evolve. Stay informed about any updates or amendments to ensure your future exchanges remain compliant.

Step 2: Seek Professional Guidance

Maintain a relationship with qualified intermediaries and tax professionals. They can provide ongoing guidance and ensure that your exchanges align with your financial objectives.

IX. Exploring Advanced Strategies

Step 1: Investigate Advanced 1031 Exchange Strategies

Advanced strategies, such as reverse exchanges, build-to-suit transactions, and improvement exchanges, offer additional flexibility and tax benefits. Investigate these options to optimize your future exchanges.

Step 2: Seek Legal and Tax Advice

Advanced 1031 exchange strategies can be intricate. It’s crucial to work closely with legal and tax advisors who are well-versed in these complex transactions.

X. Portfolio Assessment

Step 1: Periodic Portfolio Review

Regularly assess your real estate portfolio and overall investment strategy. Evaluate the performance of properties, the alignment with your objectives, and potential opportunities for further 1031 exchanges.

Step 2: Estate Planning

Consider the role of your real estate investments in your estate planning. Discuss your plans with legal and financial advisors to ensure a seamless transition of your assets to future generations.

A 1031 exchange is a dynamic and advantageous strategy in real estate investment. These 18 steps, organized into the initial 10 steps of executing an exchange and the subsequent strategies and considerations, provide a comprehensive roadmap for investors looking to unlock the tax benefits and growth potential inherent in 1031 exchanges.

The key to successful 1031 exchanges is diligent preparation, professional guidance, and a keen eye on your long-term financial goals. By following these steps and remaining adaptable in your investment approach, you can make the most of the opportunities offered by 1031 exchanges and pave the way for a prosperous and tax-efficient real estate investment portfolio.

Call us today:

Call us today: