A 1031 exchange is a powerful tax-deferral strategy that allows real estate investors to sell one property and purchase another, like-kind property while deferring capital gains taxes. Mastering this process can unlock significant financial benefits and portfolio growth potential. In this guide, we’ll break down the 1031 exchange into 10 straightforward steps, making the seemingly […]

In the world of real estate investment, the 1031 Exchanges stands out as a powerful and often underutilized tool. This tax-deferral strategy, enshrined in Section 1031 of the Internal Revenue Code, offers a myriad of advantages to savvy investors. In this comprehensive guide, we will delve into the benefits of using a 1031 exchange, shedding […]

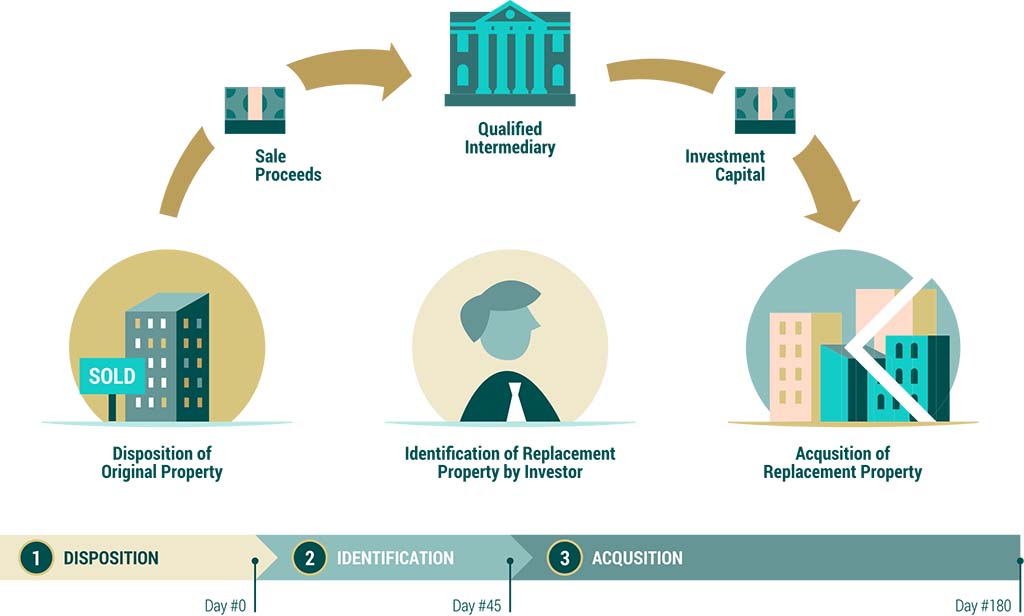

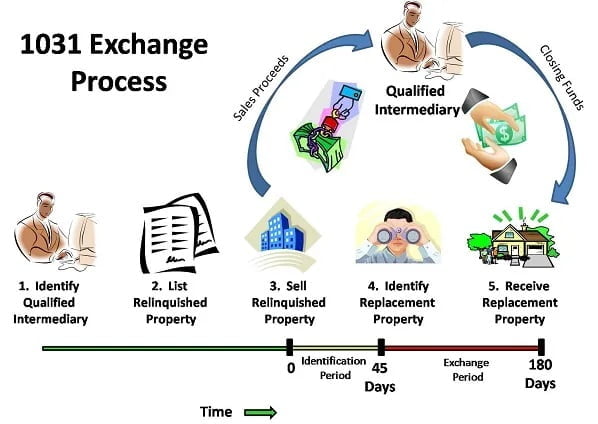

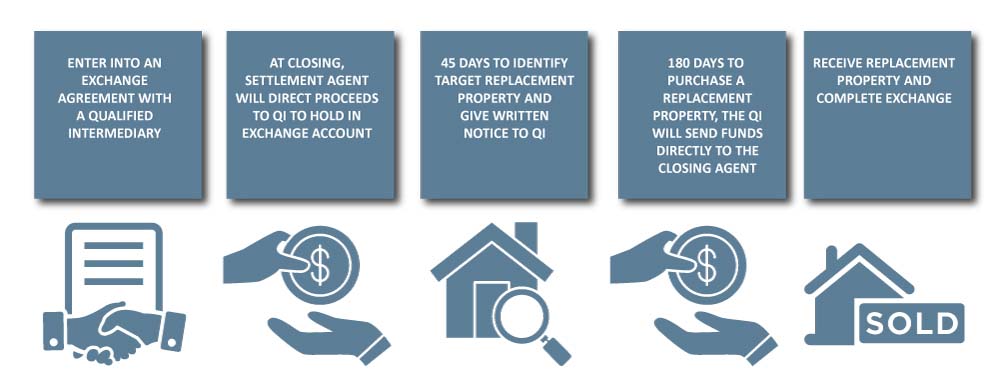

Real estate investment is a powerful wealth-building tool, and understanding the various financial strategies within this field is essential for success. One such strategy is the 1031 exchange, a tax-deferral mechanism that has been a linchpin of real estate investment for decades. In this comprehensive guide, we’ll delve into the 1031 exchange, demystify its intricacies, […]

- 1

- 2

Call us today:

Call us today: