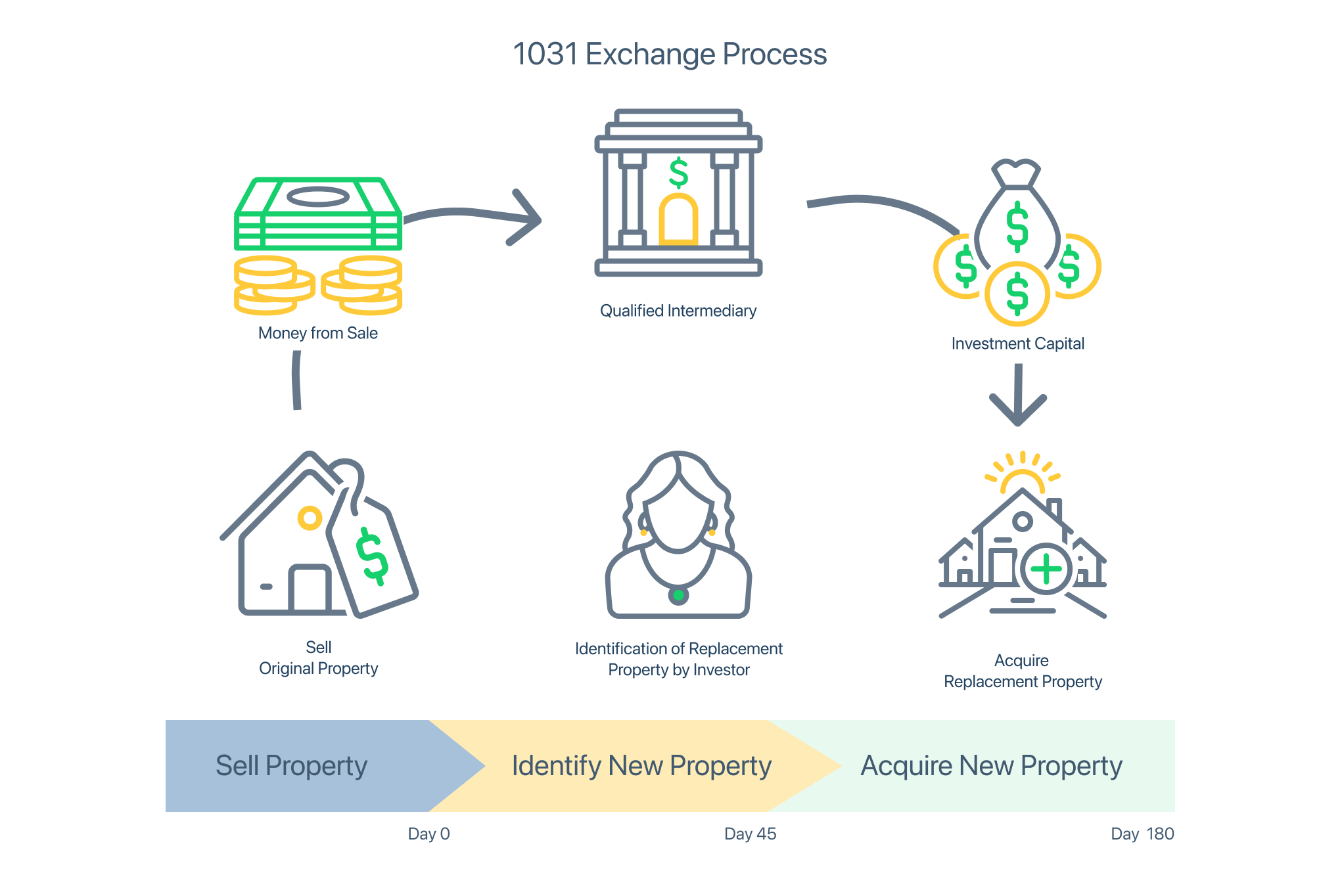

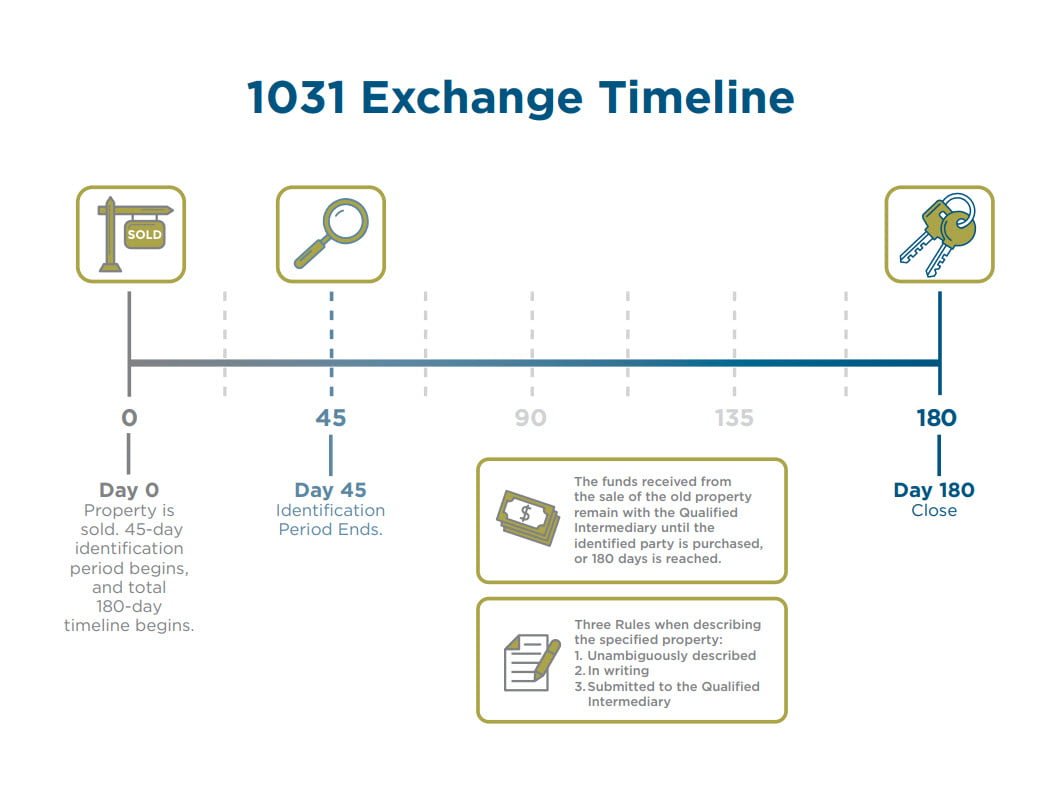

Investing in industrial properties can yield lucrative returns, but it’s essential for property owners to explore avenues that can maximize their profits while minimizing tax liabilities. One such avenue is the 1031 Exchange, a powerful tool in the real estate investor’s toolkit. In this article, we’ll delve into the intricacies of the 1031 Exchange specifically […]

Exchange for Commercial Property: Commercial property owners navigating the complex landscape of real estate investments often seek strategic tools to optimize their portfolios. One such powerful strategy is the 1031 Exchange, specifically tailored to meet the unique needs of commercial property transactions. In this article, we’ll explore the advantages, guidelines, and best practices for commercial […]

1031 Exchange for Investment: Investment property owners often find themselves exploring avenues to optimize their portfolios and minimize tax liabilities. One powerful tool in their arsenal is the 1031 Exchange. In this article, we’ll delve into the intricacies of the 1031 Exchange, uncovering its benefits, processes, and potential pitfalls. Understanding 1031 Exchange The 1031 Exchange, […]

For business owners, A 1031 exchange offers a strategic opportunity to optimize their commercial real estate investments while deferring capital gains taxes. In this comprehensive guide, we delve into the intricacies of A 1031 exchange for business owners, providing insights and strategies for leveraging this powerful tax-deferral tool to enhance their business and financial goals. […]

For real estate investors, the 1031 exchange is a powerful tool that can unlock a world of opportunities while deferring capital gains taxes. In this comprehensive guide, we explore the ins and outs of the 1031 exchange for real estate investors, providing insights, tips, and essential information for those looking to leverage this tax-deferral strategy […]

The 1031 Exchange FAQ offers a valuable resource for real estate investors seeking to grasp the intricacies of this tax-deferral strategy. Whether you are a seasoned investor or new to the concept, these Frequently Asked Questions provide an informative guide to better understand the core principles of 1031 exchanges. It is not uncommon for questions […]

1031 exchanges have long been a powerful strategy for real estate investors, providing opportunities to defer taxes and enhance their property portfolios. To gain deeper insights into the practical benefits and potential pitfalls of 1031 exchanges, we’ll explore real-world 1031 Exchange Case Studies. These examples shed light on how investors have leveraged 1031 exchanges, offering […]

Find the Right 1031 Exchange: Executing a successful 1031 exchange requires a qualified intermediary (QI) to facilitate the process. The intermediary plays a critical role in ensuring the exchange complies with IRS regulations and proceeds smoothly. However, choosing the right intermediary is a crucial decision for any real estate investor. In this comprehensive guide, we […]

As a beginner venturing into the world of 1031 exchange tips, you may find it initially overwhelming, but remember that with the right knowledge and guidance, it can be a highly rewarding investment strategy. By embracing diversification, assessing financing options, and remaining flexible in response to market trends, you can take full advantage of the […]

A 1031 exchange is a valuable tool in the real estate investor’s arsenal, offering the potential for tax savings, capital preservation, and portfolio growth. However, it’s not without its complexities, and there are common pitfalls that investors must steer clear of to ensure a successful exchange. In this comprehensive guide, we will delve into the […]

- 1

- 2

Call us today:

Call us today: