Real estate investment is a powerful wealth-building tool, and understanding the various financial strategies within this field is essential for success. One such strategy is the 1031 exchange, a tax-deferral mechanism that has been a linchpin of real estate investment for decades. In this comprehensive guide, we’ll delve into the 1031 exchange, demystify its intricacies, and explore its potential benefits and pitfalls.

I. The Basics of 1031 Exchanges

A. Definition and Origins

The 1031 exchange, named after Section 1031 of the Internal Revenue Code, is a tax-deferral strategy that allows real estate investors to swap one property for another without triggering immediate capital gains taxes. This concept has its roots in the early 20th century and has since become a critical tool for property investors.

B. Key Terminology and Concepts

- Like-Kind Property: The term “like-kind” does not mean identical properties. Instead, it refers to a wide range of real estate investments. You can exchange a residential property for a commercial one, or vacant land for a rental property, as long as they are held for investment or business purposes.

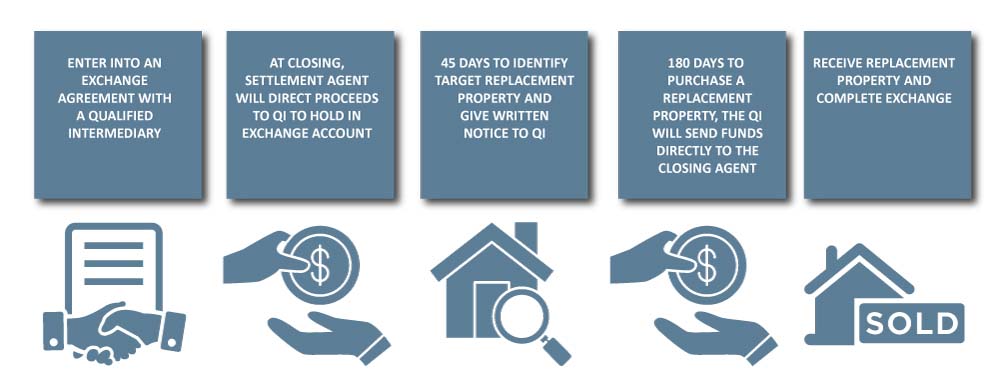

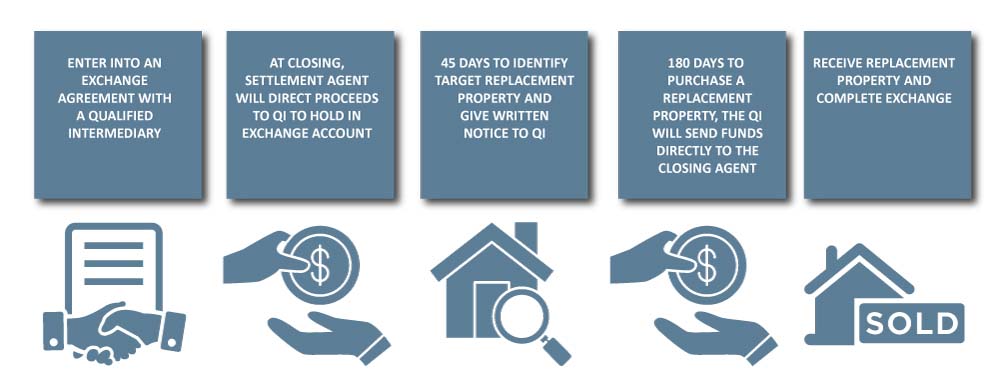

- Qualified Intermediary: To execute a 1031 exchange, investors must use a qualified intermediary (QI), a neutral third party responsible for facilitating the exchange. The QI holds the sale proceeds, helps identify replacement properties, and ensures the exchange adheres to IRS regulations.

- Exchange Timeline and Rules: There are specific timeframes for identifying and closing on replacement properties. Understanding these rules is crucial for a successful exchange.

C. Historical Context and Legislative Background

To comprehend the significance of 1031 exchanges, it’s essential to delve into their historical context and the legislative framework that supports them. Over time, the rules have evolved, affecting who can participate and the types of property eligible for exchange.

II. Eligibility and Requirements

A. Who Can Benefit from a 1031 Exchange?

While 1031 exchanges are open to a broad range of investors, there are eligibility criteria and limitations to consider. Individuals, partnerships, corporations, LLCs, and more can engage in 1031 exchanges. However, there are restrictions for primary residences.

B. Types of Properties Eligible for Exchange

Understanding which properties qualify for a 1031 exchange is crucial. Eligible property types encompass a wide spectrum, including commercial real estate, rental properties, undeveloped land, and more. However, personal residences and inventory properties are generally excluded.

C. Timing and Identification Rules

Executing a 1031 exchange is not a leisurely process. There are strict timelines for identifying potential replacement properties and completing the exchange. Failure to meet these deadlines can result in unfavorable tax consequences.

D. Special Considerations for Personal Property

In addition to real estate, 1031 exchanges can also involve personal property, such as business equipment or artwork. However, the rules for personal property exchanges are different from those for real estate.

III. The Process of a 1031 Exchange

A. Step-by-Step Guide to a 1031 Exchange

Navigating a 1031 exchange involves several steps. These include selling the relinquished property, identifying potential replacement properties, and closing the exchange with the assistance of a qualified intermediary. We’ll provide a detailed breakdown of the process.

B. Role of Intermediaries and Their Responsibilities

Qualified intermediaries play a critical role in the exchange process, acting as facilitators and ensuring compliance with IRS regulations. They hold sale proceeds, guide investors through the identification process, and assist in executing the exchange.

C. Common Challenges and Pitfalls to Avoid

While 1031 exchanges offer significant tax advantages, there are common pitfalls and challenges that investors should be aware of. Understanding these issues can help you navigate the process more effectively.

D. Case Study or Real-Life Example

A real-life case study will illustrate the process of a successful 1031 exchange. This practical example will provide insights into the challenges, strategies, and financial benefits of this tax-deferral tool.

IV. Benefits and Advantages

A. Tax Advantages of 1031 Exchanges

One of the primary benefits of a 1031 exchange is the potential for tax savings. By deferring capital gains taxes, investors can allocate more capital to new, potentially more profitable investments.

B. Wealth-Building Potential for Real Estate Investors

The ability to continually reinvest and grow your real estate portfolio without immediate tax consequences can be a powerful wealth-building tool. We’ll explore how 1031 exchanges contribute to financial success in real estate investing.

C. Case Studies Illustrating Successful 1031 Exchanges

We’ll examine real-life examples of investors who have leveraged 1031 exchanges to grow their real estate portfolios and maximize their profits.

D. Comparing 1031 Exchanges with Alternative Strategies

While 1031 exchanges offer substantial advantages, we’ll also discuss other tax-deferral strategies in real estate and when it might be more advantageous to choose an alternative approach.

V. Risks and Challenges

A. Potential Drawbacks and Risks of 1031 Exchanges

While 1031 exchanges offer numerous benefits, they are not without risks. We’ll explore some potential downsides, including the risk of over-leveraging, market fluctuations, and the complexity of the process.

B. Legislative and Regulatory Changes Affecting 1031 Exchanges

The world of tax law is ever-evolving, and 1031 exchanges are not immune to legislative changes. We’ll discuss recent developments and how changes in tax regulations may impact the future of 1031 exchanges.

C. Case Studies of Failed 1031 Exchanges and Lessons Learned

Learning from the experiences of others can be invaluable. We’ll examine real-world cases of failed 1031 exchanges to better understand the common pitfalls and how to avoid them.

VI. 1031 Exchange Strategies

A. Overview of Various 1031 Exchange Strategies

There is no one-size-fits-all approach to 1031 exchanges. We’ll provide an overview of different strategies, including simultaneous exchanges, delayed exchanges, and reverse exchanges, among others.

B. Pros and Cons of Different Approaches

Each strategy comes with its own set of advantages and disadvantages. We’ll help you evaluate which approach aligns best with your investment goals and the specific circumstances of your exchange.

C. Tailoring Strategies to Individual Investment Goals

Successful 1031 exchanges are often the result of careful planning and strategy selection. We’ll discuss how to tailor your 1031 exchange strategy to meet your investment objectives and risk tolerance.

VII. Case Studies

A. In-Depth Examination of Successful 1031 Exchange Case Studies

We’ll provide detailed analyses of successful 1031 exchange cases across various property types and investment scenarios. These case studies will showcase the practical application of the strategies discussed in this article.

B. Diverse Examples Across Different Property Types and Investment Scenarios

Real estate investments span a wide range of property types, from commercial and residential to vacant land and personal property. We’ll feature diverse examples to cater to different readers’ interests and investment preferences.

C. Analysis of Key Strategies and Outcomes in Each Case

In each case study, we’ll break down the key strategies employed, the specific properties involved, and the financial outcomes. These analyses will help readers better grasp the real-world implications of 1031 exchanges.

VIII. Alternatives to 1031 Exchanges

A. Other Tax-Deferral Strategies in Real Estate

While 1031 exchanges are powerful, they are not the sole tax-deferral strategy in real estate. We’ll explore alternative options, such as Opportunity Zones, installment sales, and the Delaware Statutory Trust (DST).

B. Comparison Between 1031 Exchanges and Alternative Methods

To make informed investment decisions, it’s essential to understand how 1031 exchanges stack up against other tax-deferral strategies. We’ll provide a comparative analysis to help you decide which strategy aligns with your financial goals.

C. When a 1031 Exchange Might Not Be the Best Option

There are scenarios in which a 1031 exchange may not be the most suitable choice. We’ll discuss circumstances where alternative methods might be more advantageous.

IX. Recent Developments and Future Outlook

A. Recent Changes in 1031 Exchange Regulations and Legislation

The legislative landscape is ever-evolving. We’ll cover the most recent changes in 1031 exchange regulations and their implications for investors.

B. Expert Opinions on the Future of 1031 Exchanges

To provide a well-rounded perspective, we’ll include insights and opinions from real estate experts and tax professionals regarding the future of 1031 exchanges and their role in the real estate market.

C. The Role of 1031 Exchanges in the Evolving Real Estate Market

The real estate market continually adapts to economic, technological, and societal changes. We’ll explore how 1031 exchanges fit into the broader context of an evolving real estate landscape.

X. Conclusion

A. Recap of Key Takeaways from the Article

In our conclusion, we’ll recap the key takeaways from this comprehensive guide on 1031 exchanges, summarizing the essential points to remember.

B. Encouragement for Readers to Explore 1031 Exchanges Further

We’ll encourage readers to delve deeper into 1031 exchanges, whether through additional research, consultation with experts, or hands-on experience.

C. Final Thoughts on the Enduring Value of 1031 Exchanges in Real Estate

We’ll end with a reflection on the enduring value of 1031 exchanges as a potent tool for real estate investors, emphasizing their capacity to drive wealth creation and financial success.

XI. Additional Resources

A. Recommendations for Further Reading and Research

For readers eager to expand their knowledge, we’ll provide a list of recommended books, articles, and websites for further exploration.

B. Links to Relevant Government Regulations and Guidelines

Easy access to IRS guidelines and regulations is vital for investors considering 1031 exchanges. We’ll include links to official resources to aid readers in understanding the legal framework.

C. Contact Information for Experts in 1031 Exchanges and Real Estate Investing

For those seeking personalized guidance, we’ll provide contact information for experts in 1031 exchanges and real estate investing.

XII. Endnotes

A. Citations and References for Information Used in the Article

The endnotes will include citations and references for all information, ensuring the accuracy and credibility of the content presented in this comprehensive guide. With this two-part article, readers will gain a deep understanding of 1031 exchanges, from the basics and eligibility to the process, benefits, risks, strategies, case studies, alternatives, and insights into the future of this essential tool in real estate investment.

Call us today:

Call us today: