As a beginner venturing into the world of 1031 exchange tips, you may find it initially overwhelming, but remember that with the right knowledge and guidance, it can be a highly rewarding investment strategy. By embracing diversification, assessing financing options, and remaining flexible in response to market trends, you can take full advantage of the opportunities presented by 1031 exchanges.

1031 Exchange Tips: Crafting a long-term strategy, building a network of industry experts, and conducting regular portfolio assessments ensure that your investments align with your financial objectives and thrive in the ever-evolving real estate landscape. By implementing these tips, you not only set the stage for successful 1031 exchanges but also establish a strong foundation for your future in real estate investment. Always keep in mind that a well-informed and adaptable approach is your pathway to financial growth and security in the dynamic world of real estate.

A 1031 exchange, a powerful tax-deferral strategy, offers tremendous advantages to real estate investors. However, for beginners, the process can seem daunting and complex. To help newcomers navigate the world of 1031 exchanges with confidence, we have compiled essential tips to ensure a successful exchange. By following these guidelines, you can maximize the benefits of tax deferral, preserve capital, and facilitate portfolio growth. Get details of the 1031 Exchange Tips that is provided below.

1031 Exchange Tips for Beginners

I. Understand the Basics

Tip 1: Grasp the Fundamentals

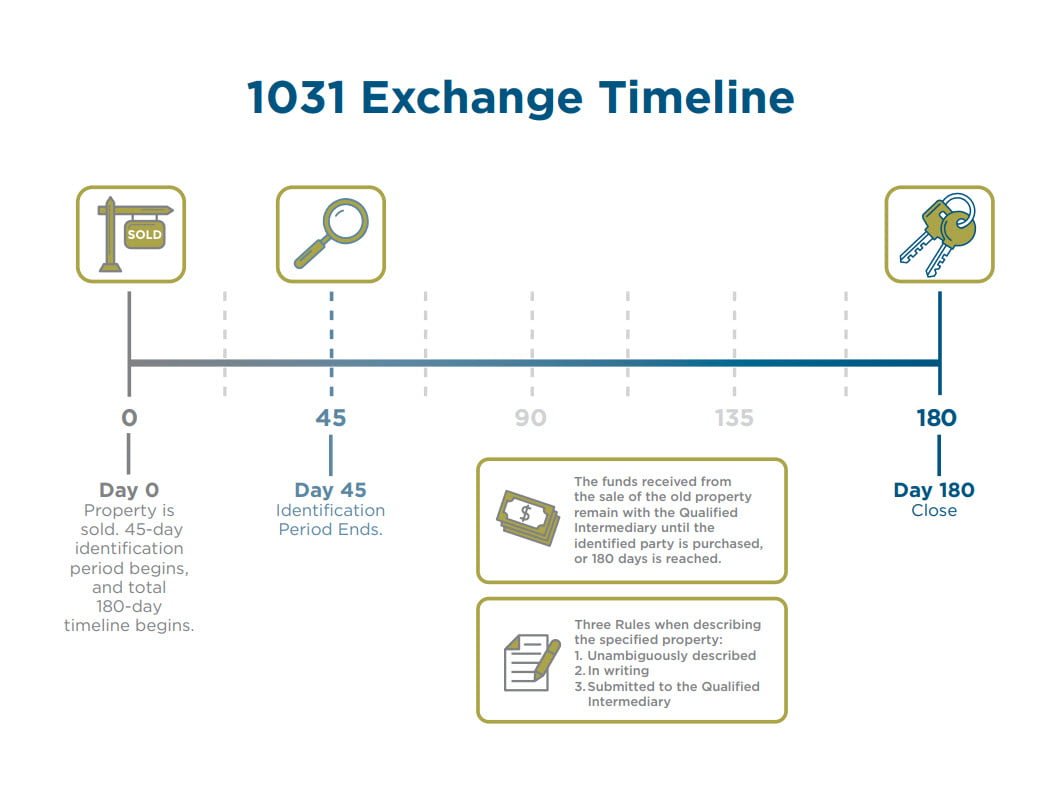

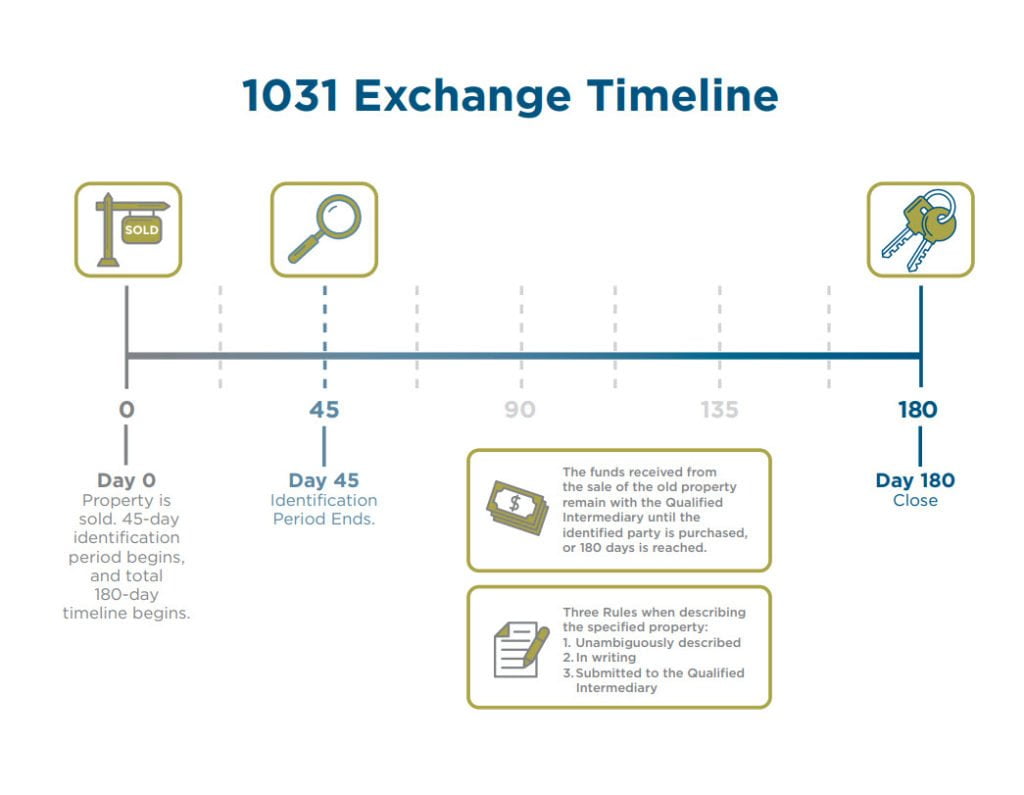

Before embarking on a 1031 exchange, take the time to understand the basic concepts. Familiarize yourself with the like-kind property requirement, the role of a qualified intermediary (QI), and the strict timelines associated with these transactions. A solid grasp of the fundamentals is crucial to ensure a smooth exchange.

Tip 2: Determine Your Eligibility

Make sure you meet the eligibility criteria for a 1031 exchange. Individual investors, partnerships, corporations, LLCs, and other entities can participate, but primary residences do not qualify. Knowing your eligibility is the first step towards a successful exchange.

II. Seek Professional Guidance

Tip 3: Choose a Qualified Intermediary

Selecting a reputable qualified intermediary (QI) is one of the most critical decisions in the 1031 exchange process. A qualified intermediary will guide you through the transaction, handle the sale proceeds, and ensure compliance with IRS regulations. Their expertise is invaluable in executing a successful exchange.

Tip 4: Consult Legal and Tax Advisors

The complexities of the tax code and real estate transactions make it imperative to seek guidance from legal and tax professionals experienced in 1031 exchanges. Their expertise will help you make informed decisions and avoid costly mistakes.

III. Plan Ahead

Tip 5: Prepare Well in Advance

Begin planning your 1031 exchange well before you intend to sell your relinquished property. Rushing the process can lead to poor investment choices and missed opportunities.

Tip 6: Identify Replacement Properties

Within 45 days of selling your relinquished property, identify up to three potential replacement properties. This 45-day window is crucial and requires careful consideration.

IV. Thorough Property Research

Tip 7: Conduct Due Diligence

Invest the time and effort to conduct thorough due diligence on potential replacement properties. This includes property inspections, market research, and understanding the property’s financial history. Proper research helps you make informed decisions and avoid costly errors.

Tip 8: Property Quality Matters

While it’s essential to adhere to the 45-day identification period, don’t sacrifice property quality for speed. A rushed decision can lead to investments that don’t align with your long-term goals.

V. Understand Tax Implications

Tip 9: Comprehend Tax Consequences

Work closely with your QI and tax advisors to fully understand the tax implications of your 1031 exchange. Failing to grasp the tax ramifications can result in unforeseen financial burdens that undermine the primary purpose of tax deferral.

Tip 10: Be Aware of Depreciation Recapture

Depreciation recapture is a significant consideration in 1031 exchanges. Ensure that you account for it in your exchange to preserve the tax benefits you seek.

VI. Maintain Accurate Records

Tip 11: Document Everything

Proper documentation is crucial for a 1031 exchange. Maintain records of all your transactions, communications with your QI, and property-related documents to ensure compliance and prepare for potential audits.

VII. Stay Informed

Tip 12: Keep Up with Tax Law Updates

Tax laws can change, impacting 1031 exchanges. Stay informed about legislative updates and changes to ensure that your exchange remains compliant and optimized for your financial goals.

VIII. Seek Ongoing Education

Tip 13: Never Stop Learning

The world of 1031 exchanges is dynamic. Continuous education and staying informed about best practices and changing regulations is vital for success in this field.

X. Diversify Your Portfolio

Tip 14: Consider Property Types

Diversification is key to managing risk in your real estate portfolio. While conducting a 1031 exchange, consider exploring different property types. For instance, if you currently own residential properties, you might diversify into commercial real estate or industrial properties. Diversifying your investments can help mitigate risk and potentially enhance your returns. Before proceeding, consult with real estate professionals to identify sectors with promising growth prospects.

XI. Leverage Financial Resources

Tip 15: Assess Financing Options

Effective financing can be a game-changer in your 1031 exchange. Evaluate your financing options, such as conventional loans, seller financing, or even leveraging the equity from your relinquished property to acquire your replacement property. By understanding your financing choices and working with mortgage professionals, you can optimize your capital utilization and maximize the benefits of your exchange.

XII. Maintain Flexibility

Tip 16: Be Open to Market Trends

Real estate markets can change over time. Be flexible and open to adapting your investment strategy to align with market trends and economic conditions. Staying attuned to market dynamics and working closely with industry experts will allow you to make informed decisions and seize opportunities as they arise. Flexibility is a valuable trait in navigating the dynamic world of real estate.

XIII. Plan for the Long Term

Tip 17: Create a Long-Term Strategy

A 1031 exchange isn’t just about immediate tax benefits; it’s also a tool for long-term wealth building. Consider creating a long-term strategy that aligns with your financial objectives. Identify how your 1031 exchanges fit into your larger investment and retirement plans. With a clear, long-term strategy, you can build a resilient real estate portfolio that continues to grow and thrive.

XIV. Seek Professional Networks

Tip 18: Build a Team of Experts

Success in real estate investing often relies on having a strong network of professionals. Cultivate relationships with real estate agents, property managers, contractors, and other experts who can support your investment ventures. A robust professional network can provide invaluable insights, support, and resources as you expand your real estate portfolio.

XV. Evaluate Your Progress

Tip 19: Periodic Portfolio Assessment

Regularly evaluate your real estate portfolio to ensure it aligns with your financial goals. Assess the performance of your properties, the effectiveness of your 1031 exchanges, and the overall health of your investments. A periodic review allows you to adjust your strategy as needed and make informed decisions for the future.

By considering these additional tips, you can further optimize your 1031 exchange experience, expanding your real estate investment portfolio and working toward your long-term financial success. Remember that each tip contributes to a comprehensive strategy that empowers you to make the most of your 1031 exchanges and attain your financial objectives.

1031 Exchange Tips For beginners, a 1031 exchange may seem challenging, but with the right knowledge, professional guidance, and careful planning, it can be a transformative financial strategy. These tips provide a solid foundation to help you start your 1031 exchange journey on the right foot. By following these guidelines, you can confidently navigate the process, maximize the benefits, and take the first steps toward achieving your long-term financial objectives in real estate investment. Remember that while the process may seem intricate, each step is manageable when approached with knowledge and proper guidance.

Call us today:

Call us today: