1031 exchanges have long been a powerful strategy for real estate investors, providing opportunities to defer taxes and enhance their property portfolios. To gain deeper insights into the practical benefits and potential pitfalls of 1031 exchanges, we’ll explore real-world 1031 Exchange Case Studies. These examples shed light on how investors have leveraged 1031 exchanges, offering valuable lessons and inspiration for those considering this tax-deferral strategy.

In the first 1031 Exchange Case Studies, we delve into an investor’s journey towards maximizing portfolio growth through a 1031 exchange. Starting with a small residential property, the investor aspired to expand their real estate holdings and income potential. By strategically selling the residential property and engaging in a 1031 exchange, they successfully acquired a multi-unit commercial property.

1031 Exchange Case Studies

This shift allowed for a significant boost in rental income and portfolio diversification, underlining how well-executed 1031 exchanges can serve as catalysts for growth and financial prosperity. By capitalizing on the tax-deferral advantages of a 1031 Exchange Case Studies, this investor harnessed the full potential of their real estate investments, turning a modest residential property into a diversified income-generating asset that added value to their portfolio.

1031 Exchange Case Studies

I. Case Study 1: Maximizing Portfolio Growth

In this case study, we examine an investor’s journey to maximize portfolio growth through a 1031 exchange. The investor, owning a small residential property, sought to expand their real estate portfolio with higher-income potential. By selling the residential property and conducting a 1031 exchange, they acquired a multi-unit commercial property. This strategic move significantly increased rental income and diversified the investor’s holdings. The case study showcases how a well-executed 1031 exchange can serve as a catalyst for portfolio expansion and income enhancement. Thatswhy we are talking about the 1031 Exchange Case Studies as you know that it is more important.

II. Case Study 2: Tax Deferral and Wealth Preservation

This case study focuses on an investor looking to preserve their wealth while deferring taxes. With a substantial gain expected from the sale of a commercial property, the investor opted for a 1031 exchange to defer capital gains taxes. They identified a like-kind property, reinvested their proceeds, and maintained their investment momentum. This case highlights the tax-deferral benefits of 1031 exchanges and their role in preserving an investor’s wealth, allowing them to continue building their real estate portfolio.

III. Case Study 3: Avoiding Pitfalls through Proper Planning

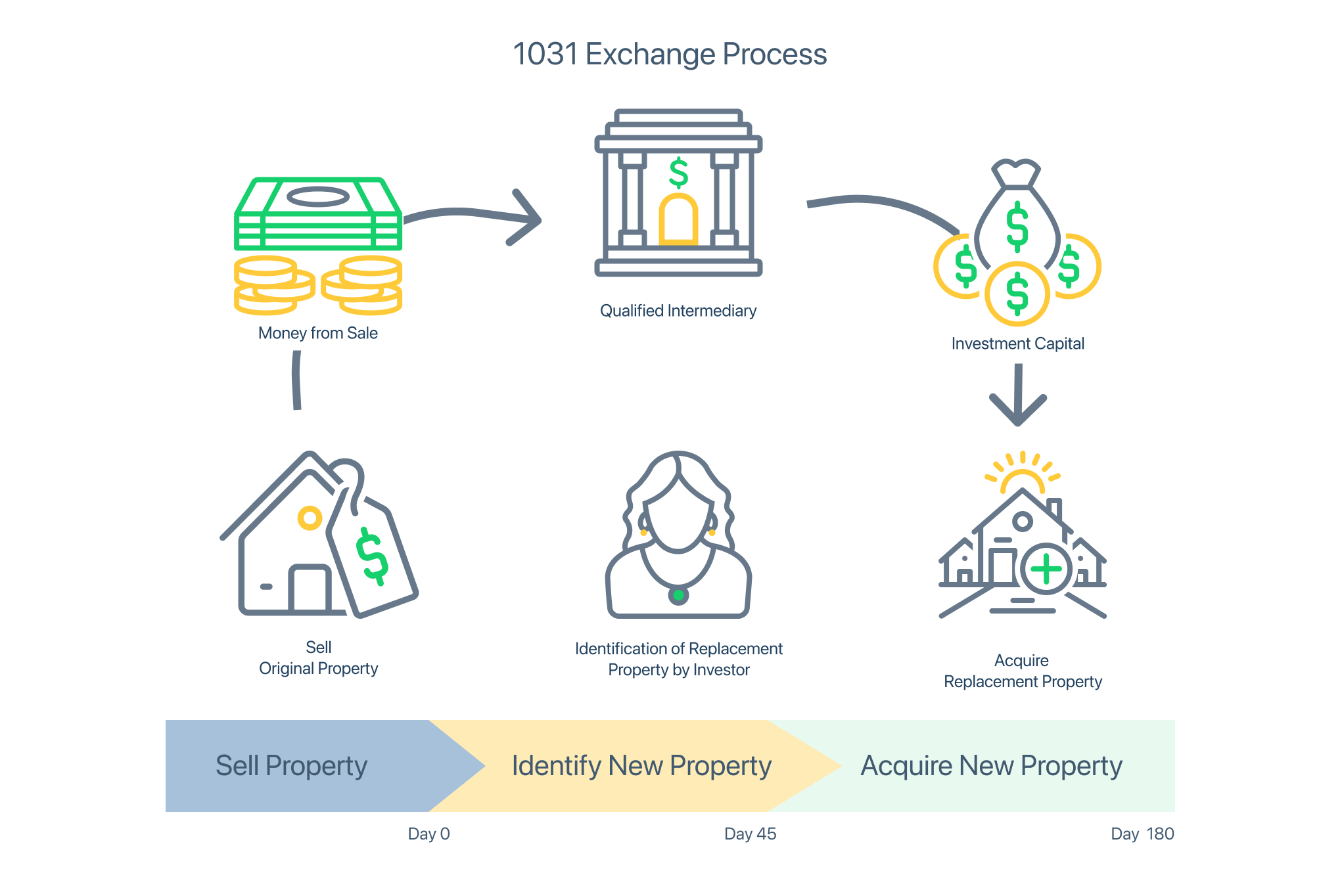

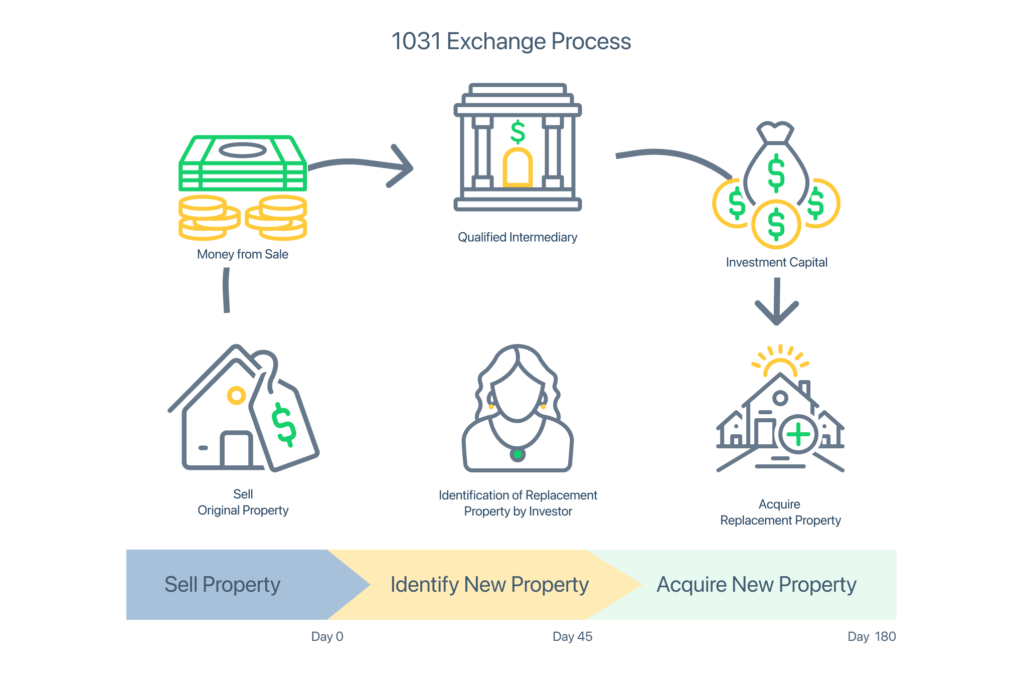

In this case study, we delve into the experience of an investor who, through meticulous planning, avoided potential pitfalls in a 1031 exchange. The investor sought to exchange a rental property but faced challenges in identifying suitable replacement properties within the 45-day identification period. By working closely with a qualified intermediary and real estate professionals, they secured backup properties and successfully completed the exchange. This case underscores the importance of thorough planning, professional guidance, and contingency strategies to overcome obstacles in the exchange process.

IV. Case Study 4: Portfolio Diversification and Income Generation

Our fourth case study explores an investor’s quest for diversification and income generation. Holding a single, high-value property, the investor wanted to reduce risk and enhance cash flow. Through a 1031 exchange, they sold the single property and reinvested in a diversified portfolio of rental properties in various locations. This case demonstrates how 1031 exchanges can be used strategically to diversify a real estate portfolio and generate consistent income streams.

V. Case Study 5: Legacy and Estate Planning

Our final case study emphasizes the role of 1031 exchanges in estate planning and leaving a legacy. An investor with a substantial real estate portfolio was concerned about the tax implications that might burden their heirs. By incorporating a well-structured 1031 exchange strategy into their estate plan, they aimed to minimize tax liabilities and ensure a seamless transfer of their real estate assets to the next generation. This case underscores how 1031 exchanges can be an integral part of long-term estate planning, helping investors pass on their wealth with reduced tax burdens.

VI. Case Study 6: Leveraging 1031 Exchanges for Retirement Planning

There are various 1031 Exchange Case Studies but In this case study, we explore how an investor strategically utilized 1031 exchanges to secure their retirement future. Facing the prospect of selling multiple properties with substantial gains, they sought a tax-efficient strategy to defer capital gains taxes. By employing 1031 exchanges, they effectively rolled over their investments into income-generating properties. This case study illustrates how 1031 exchanges can be a vital component of retirement planning, ensuring a steady income stream during retirement years.

VII. Case Study 7: Expanding Real Estate Ventures through 1031 Exchanges

In our seventh case study, we investigate how an ambitious investor employed 1031 exchanges to expand their real estate ventures. With a growing appetite for real estate, they leveraged the tax-deferral strategy to upgrade their properties and enter new markets. This case exemplifies how 1031 exchanges offer a unique avenue for investors to scale their real estate businesses, tapping into fresh opportunities while deferring capital gains taxes.

VIII. Case Study 8: Navigating a Complex Exchange with Multiple Properties

This case study delves into an investor’s experience in navigating a complex 1031 exchange involving multiple properties. Faced with the challenge of divesting several properties to streamline their portfolio, they successfully structured a simultaneous exchange involving multiple relinquished and replacement properties. This case underscores the flexibility and scalability of 1031 exchanges, even when dealing with intricate transactions.

IX. Case Study 9: Strategic Timing for Market Cycles

Our ninth case study explores an investor’s use of 1031 exchanges to align with market cycles strategically. Recognizing a shifting real estate market, they capitalized on 1031 exchanges to reposition their portfolio, optimizing it for the current economic climate. This case demonstrates how timing and market awareness are crucial factors in leveraging 1031 exchanges to enhance an investor’s real estate strategy.

X. Case Study 10: The Role of 1031 Exchanges in Business Expansion

In our final case study, we analyze an entrepreneur’s journey to expand their business footprint through 1031 exchanges. They used 1031 exchanges to transition from leasing to property ownership, securing strategic locations for their business operations. This case showcases the applicability of 1031 exchanges not only in traditional real estate investments but also in supporting business expansion and facilitating ownership of commercial spaces.

In each of these 1031 exchange case studies, the versatility of 1031 exchanges shines through, illustrating the myriad ways in which investors and entrepreneurs leverage this tax-deferral strategy to achieve their unique financial goals and enhance their real estate portfolios. These real-world examples serve as a testament to the enduring relevance of 1031 exchanges in the dynamic landscape of real estate and business ownership.

These 1031 exchange case studies demonstrate the diverse ways in which investors have leveraged this tax-deferral strategy to achieve their unique financial goals. Whether it’s portfolio growth, wealth preservation, risk mitigation, income generation, or estate planning, 1031 exchanges offer versatile solutions. However, each case study also underscores the importance of careful planning, professional guidance, and a clear understanding of IRS regulations. By learning from these real-world examples, investors can harness the full potential of 1031 exchanges to optimize their real estate investments and financial objectives.

Call us today:

Call us today: